Drop off your CV

We'd love to hear from you. Send us your CV and one of our specialist consultants will be in touch.

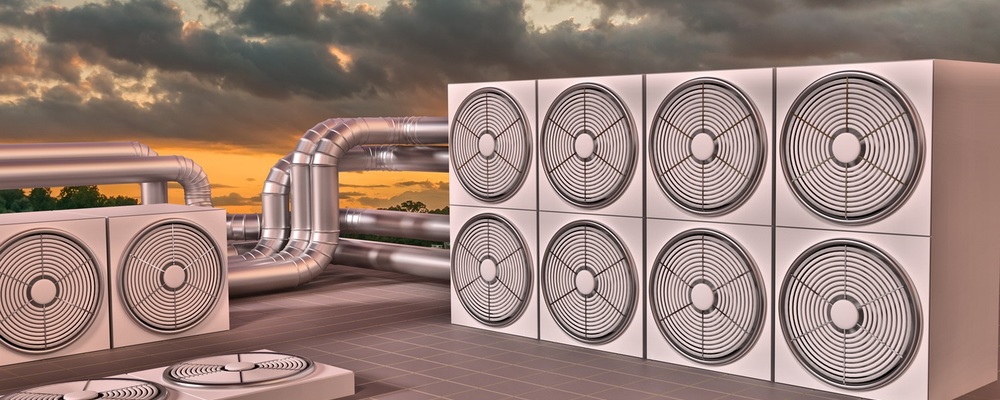

Last year, we wrote about the prospects for HVAC in 2016, noting how a number of positive industry metrics indicated blue skies ahead for the global HVAC market. But a year is a long time in business, and it feels like a lot has changed since writing that article. After one of the most notably unpredictable and dramatic years in recent memory, has much changed for the HVAC industry, and do business leaders have reason to feel optimistic with the political and economic upheaval that may lie ahead?

In short, the answer is yes – although there are a few factors which must be taken into account when planning for changing conditions ahead. The good news, first: certain factors which drive demand within the HVAC market aren’t likely to change anytime soon. The demand for new housing and construction in general in increasingly densely populated urban areas continues to power growth for our sector. According to the latest Markit/CIPS UK Construction PMI figures, the UK construction industry was able to grow at its fastest rate so far this year - primarily due to a strong performance in civil engineering.

Business optimism is also high, meaning increased spending on facilities and expansion is likely to continue to propel industry expansion. According to a recent AHR Expo and ASHRAE Journal survey sent to more than 1,400 HVACR manufacturers worldwide, there is growing optimism for improving economic prospects in 2017. Based on survey results, 86 percent of the respondents expect their sales to grow in the coming year, and an astonishing 98 percent indicate a positive outlook on the prospects for the industry as a whole for 2017.

Top-level growth predictions continue to look positive for our market as well. The HVACR systems market was valued at $81.1bn in 2015, yet is expected to grow by 5.5% each year through 2020, which could lead to a potential valuation of $130.7bn by that time. Refrigeration in particular will account for a large part of that growth as food processing and cold storage each expand respectively, as well as the aforementioned residential construction market, meaning more need for both residential and commercial HVAC services. Yet the current workforce shortage in the HVAC industry is only likely to worsen in the years to come, as the baby boomer generation slowly drops off the industry’s workforce. Analysts have suggested that we could see a talent shortage of over 138,000 employees by 2022, and so bespoke HVAC recruitment strategies need to be high on the agenda for businesses looking to plan succession for valued senior staff.

Energy efficiency will continue to be an issue at the top of HVAC businesses’ agendas for 2017 and beyond, and may be the key growth area where forward-thinking organisations can leave their competition behind. Sales are fast growing in this particular segment of the commercial HVAC market; a report conducted by Navigant Research concluded that “global revenue for energy-efficient commercial systems is expected to increase from $22.8bn in 2015 to $47.5bn in 2024”. Just as with the market as a whole, niche talent in technical sales and senior management is required to spearhead growth in this field, however, and the competition to secure the services of a relatively small talent pool is fierce.

CSG’s dedicated HVAC team have a proven track record of sourcing the best talent in the HVAC market for roles where all traditional recruitment methods have failed. We work closely with a network of skilled, proactive candidates and innovative clients to meet and excel recruitment expectations, each and every time.